Find the current interest rate on a Sun Life Financial Benefit Account (SLFBA)?

Interest on SLFBA assets is compounded daily at an annual rate of 0.25% and is credited once a month. The rate is not guaranteed and is subject to change.

For employees covered for Group Life, Disability or Dental at work.

How do I . . .

Find the current interest rate on a Sun Life Financial Benefit Account (SLFBA)?

Interest on SLFBA assets is compounded daily at an annual rate of 0.25% and is credited once a month. The rate is not guaranteed and is subject to change.

What's needed: Download and complete either the Death Claim Packet (for all death claims) or the Life and Disability Claim Packet (for all Waiver of Premium, Accelerated Benefit, Accidental Dismemberment, or Permanent Total Disability claims). Be sure to include all required documentation with your claim submission. Required documentation may include a certified death certificate (for death claims) and/or the insured's original insurance enrollment form (available from the insured's employer).

Mail to:

Sun Life and Health Insurance Company (U.S.)

Group Life Claims, SC 3225

One Sun Life Executive Park

P.O. Box 81100

Wellesley Hills, MA 02481

Waiver of Premium is a provision that continues your Group Life premium payments if you become totally disabled.

If you become totally disabled and your Waiver of Premium claim is approved by Sun Life, we will continue your life coverage without further payments from you or your employer. To be eligible for Waiver of Premium, you must be totally disabled prior to age 60.

What's needed: Download and complete sections B and C of the Life and Disability Claim Packet. Be sure your employer completes section A of the claim packet. Also, provide section D to your attending physician to complete and submit.

Notice of waiver claim must be submitted within 12 months of your last date actively at work and proof of claim must be submitted within 15 months of your last date actively at work. In order to be eligible for waiver, you must be totally disabled prior to age 60.

Mail to:

Sun Life and Health Insurance Company (U.S.)

Group Life Claims, SC 3225

One Sun Life Executive Park

P.O. Box 81100

Wellesley Hills, MA 02481

What's needed: Download and complete the Beneficiary Designation Form and submit it to your employer for processing. (Your employer's Human Resources department keeps a record of your designation.)

Exception: If you are on Waiver of Premium, mail or fax the Beneficiary Designation Form directly to Sun Life (U.S.):

Mail to:

Sun Life and Health Insurance Company (U.S.)

Group Life Department, SC 3225

One Sun Life Executive Park

Wellesley Hills, MA 02481

Fax to: 781-446-1517

Yes. After your date of termination or retirement, you have 31 days (may vary by policy) to notify Sun Life (U.S.) of your intention to convert your group term coverage to an individually owned whole life policy. If you opt to convert, you will be responsible for paying the life premium. The cost of conversion coverage is different from your group coverage.

What's needed:

Mail to:

Sun Life and Health Insurance Company (U.S.)

Group Life Conversion, SC 1219

One Sun Life Executive Park

Wellesley Hills, MA 02481

How do I . . .

To file a Short- or Long-Term Disability or paid family and medical leave* claim, you will need to complete a claim statement, which asks for the following information:

You can submit Short- and Long-Term Disability claims online. Paper forms will need to be completed and returned to us for paid family and medical leave claims.

*Applicable with paid family medical leave coverages you have with us. If you’re submitting a disability claim, we will initiate any statutory disability and paid family and medical leave coverages that may apply.

As soon as you receive a claim number from us via mail, you can call or visit us online to get up-to-date information about your claim.

Phone: Call 800-247-6875 and follow the prompts for automated service

Online:

Watch our video to learn how to track a claim online

Definitions of disability terms are available:

Definitions of basic disability terms are listed alphabetically in the Glossary of Terms. Select the letter of the term you want defined. NOTE: The Glossary of Terms provides a general, summarized explanation of terms used in your employer's Group Policy. The Group Policy is the document that describes the insurance company's contract to provide benefits. If the terms listed in this glossary and the Group Policy differ, the Group Policy will govern. See your employer for a copy of the Group Policy.

Waiting Period: The length of time that a new employee (or one who has recently enrolled in the Group Policy) must wait before he or she is covered under the policy. The length of the Waiting Period varies by employer. Check with your employer, or see your Employee Benefits booklet for the specific provisions of the Group Policy.

Elimination Period: The period of time that a claimant must be continuously disabled prior to becoming eligible for consideration of benefits. Elimination Periods vary by employer. For your Group Policy's Elimination Period, check with your employer or see your Employee Benefits booklet.

As soon as we receive all of the information requested on the claim form, and all supporting documentation that may be required, we begin working to deliver a timely and sound claim decision.

Each disability claim we receive is handled according to its own circumstances and facts. Please be assured that, should processing of your claim be delayed for any reason, we will notify you as soon as possible.

A complete description of all of the procedures and guidelines pertaining to claim processing are specified in your employer's Group Policy. For more information, ask your employer or see your Employee Benefits booklet.

How do I . . .

Sun Life and Health Insurance Company (U.S.) is not responsible for paying claims for work-related injuries. Such claims should be directed to your employer's workers' compensation insurer.

Short-Term Disability (STD) insurance pays benefits for your own medical condition that prevents you from performing the material and substantial duties of your occupation. Benefits begin soon after a disability starts. STD benefits continue for a limited amount of time, usually 6 to 26 weeks depending on the condition.

If you expect to be absent from work for longer than your STD plan's Elimination Period, then you may file an STD claim. Use these general definitions to familiarize yourself with the differences between short-term and long-term disability.

What's needed: To notify Sun Life and your employer of a Short-Term Disability claim, you may submit your claim online or by paper. You can find the required forms by selecting Find a form on the home page of www.sunlife.com/us.

Online through your Sun Life account:

Email: myclaimdocuments@sunlife.com

Mail:

Sun Life Assurance Company of Canada

Group Short-Term Disability

P.O. Box 81915

Wellesley Hills, MA 02481

Fax to: 781-304-5599

To submit a paper claim, follow these steps:

Note: If you’re submitting a disability claim, we will initiate any statutory disability and paid family medical leave coverages that may apply.

Under the Family and Medical Leave Act (FMLA), eligible employees of qualified organizations have the right to take up to 12 weeks of unpaid leave during a 12-month period.

While FMLA doesn't offer any benefits that would affect a short-term disability, FMLA does guarantee you job availability once you return from your medical leave.

Health care coverage may be continued during the leave at the same contribution level as before. The employer can recoup premiums that were paid for continued benefits if the employee does not return to work. Please contact your employer for more information.

Follow your how to file a claim instructions provided by your employer. Or call us at 800-247-6875, Monday through Friday from 8 a.m. to 8 p.m. ET.

Benefits are based on appropriate doctor certification. Typically, you become eligible for benefits on the day you deliver. Please note, there may be a short period of time, called an Elimination Period, before benefit checks actually begin. Ask your employer or refer to your Employee Benefits booklet to determine the length of your Elimination Period.

Short-term disability benefits typically end six weeks after your delivery date. If you have medical complications that prevent you from doing your job, we will review the medical records provided by your doctor and may extend your benefits beyond this timeframe.

If you have medical complications that prevent you from doing your job, we will review medical records provided by your doctor and may provide benefits prior to your expected delivery date.

You should only file a Long-Term Disability claim if you have been unable to work because of a disabling illness or injury for 6 to 12 months. Use these general definitions to familiarize yourself with the differences between Long-Term and short-term disability.

What's needed: To notify Sun Life and your employer of a Long-Term Disability claim, you may use our online claims system or submit a paper form. You can find the required forms by selecting Find a form on the home page of www.sunlife.com/us.

Online through your Sun Life account:

To submit a paper form, follow these steps:

Download and complete the LTD Claim - Employee's Statement and submit with supporting medical evidence of total disability. Your employer must submit the LTD Claim - Employer's Statement . Your physician must submit the LTD Claim - Attending Physician's Statement . You should submit your claim as soon as you determine that your disability will last beyond the elimination period.

Mail to:

Sun Life (NY)

Group Long-Term Disability, SC 3208

One Sun Life Executive Park

P.O. Box 81830

Wellesley Hills, MA 02481

Fax to: 781-304-5599

Email: myclaimdocuments@sunlife.com

The maximum benefit period is based on the schedule of benefits in your employer's Group Policy. Most policies have an "Own Occupation" standard that requires you to be unable to perform the duties of your own occupation in order to receive benefits. Depending on the terms of the Group Policy, "Own Occupation" benefits may last for two, three or five years.

After the "Own Occupation" period ends, most Group Policies switch to an "Any Occupation" standard that requires you to be unable to perform the duties of any occupation for which you are qualified by education or experience in order to receive benefits.

Your benefits while under the "Any Occupation" standard will end at retirement or at a specific age, depending on your employer's Group Policy. For the exact terms and conditions of your eligibility for, and entitlement to, LTD benefits, please see your employer's Group Policy, check with your employer, or see your Employee Benefits booklet.

How do I . . .

A sick leave claim generally is the same as a short-term disability claim. It covers an employee's pay during short-term absences from work (more than a few days, but less than 6 months) due to your own medical condition that prevents you from performing the material and substantial duties of your occupation. "Sick leave" is a general term used by some employers to distinguish their plan from short-term disability insurance or payroll.

If your employer has such a plan, and you are absent for the number of days specified by your employer, then you should notify your employer that you will be starting a sick leave.

SunAdvisor is a service of Sun Life (U.S.) that provides claims expertise to employers who are administering their own sick leave or short-term disability plan.

Sun Life and Health Insurance Company (U.S.) does not insure benefits under the employer's benefits plan when providing SunAdvisor services. The employer remains responsible for the risks and liabilities covered by its benefits plan.

What's needed: To notify Sun Life (U.S.) and your employer of a sick leave claim, follow these steps:

Online through your Sun Life account

To submit a paper claim, follow these steps:

Note: If you’re submitting a disability claim, we will initiate any statutory disability and paid family medical leave coverage that may apply.

Online through your Sun Life account:

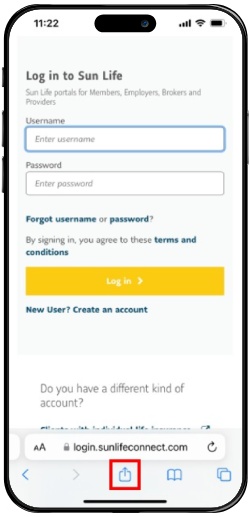

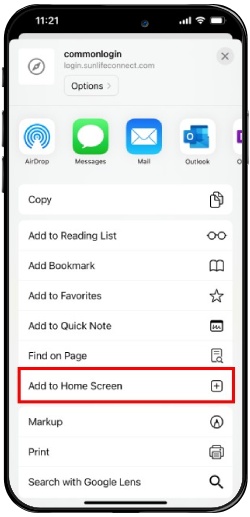

For iPhone users:

3. From the menu, select Add to Home Screen.

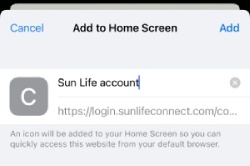

4. Give your icon the name Sun Life account and then select Add.

Your new website icon will now be visible on your phone’s home screen. You can select this icon at any time to quickly access your Sun Life account.

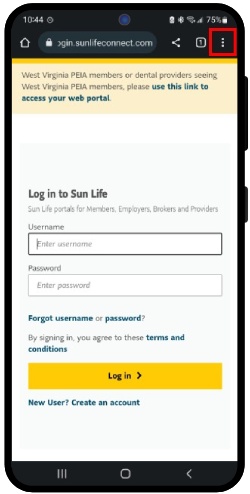

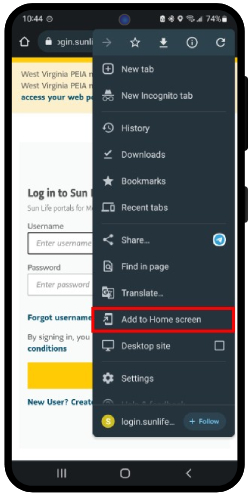

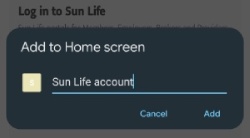

For Android users:

3. From the drop-down menu, select Add to Home screen.

4. Give your icon the name Sun Life account and then select Add.

5. Select Add again if asked a second time.

Your new website icon will now be visible on your phone’s home screen. You can select this icon at any time to quickly access your Sun Life account.

Group insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York. In New York group insurance policies are issued by Sun Life and Health Insurance Company (U.S.) (Lansing, MI). Product offerings may not be available in all states and may vary depending on state laws and regulations.

SLPC 30680 exp 5/23