If you are not a broker or consultant, explore our content for plan members and families, employers, or dentists and dental offices.

Massachusetts Paid Family and Medical Leave (MA PFML)

Sun Life is eager to meet your Massachusetts PFML needs for private plan administration. Sun Life's MA PFML plan integrates with Short-Term Disability, featuring one claims number for your employees’ medical event, one case manager, one claim submission, and integrated reporting for employers.

Please speak to your Sun Life Sales Representative for more information.

The Massachusetts Department of Paid Family & Medical Leave (DFML) is the agency responsible for administering the MA PFML law. Learn from the DFML about private plan exemption requirements.

This site is created for our broker and employer Clients to help them comply with employer responsibilities under the MA PFML law.

Quick facts

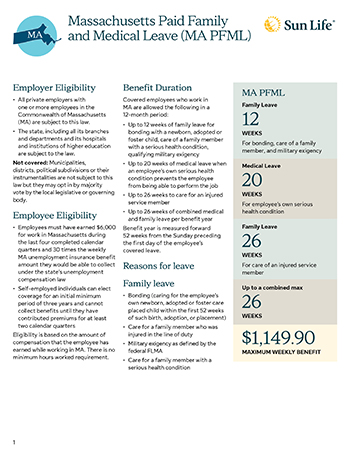

Benefit Duration

- 12 weeks for bonding, care of family member and military exigency

- 20 weeks for employee’s own serious health condition.

- 26 weeks for care of an injured service member

- Up to 26 weeks combined maximum

Reasons for Leave

Family leave

- Bonding (caring for the employee’s own newborn, adopted or foster care placed child within the first 52 weeks of such birth, adoption, or placement)

- Care for a family member who was injured in the line of duty

- Military exigency as defined by the federal FLMA

- Care for a family member with a serious health condition

Medical leave

- Employees own serious health condition that prevents the employee from being able to work

Maximum Weekly Benefit

- $1,129 for 2023

- $1,149.90 for 2024

Sun Life is committed to providing you with the most up-to-date information as it becomes available. For an in-depth look into recent updates and changes, click below.

Frequently Asked Questions

Yes. Sun Life offers both fully insured and self-insured private plan administration for employers.

- All private employers with one or more employees in the Commonwealth of Massachusetts (MA) are subject to this law.

- The state, including all its branches and departments and its hospitals and institutions of higher education are subject to the law.

Not subject to the law: Municipalities, districts, political subdivisions or their instrumentalities are not subject to this law, but they may opt in by majority vote by the local legislative or governing body.

This is a summary. More information can be found on the state website.

- Employees must have earned $6,300 for work in Massachusetts during the last four completed calendar quarters and 30 times the weekly MA unemployment insurance benefit amount they would be able to collect under the state’s unemployment compensation law

- Self-employed individuals can elect coverage for an initial minimum period of three years and cannot collect benefits until they have contributed premiums for at least two calendar quarters

- Eligibility is based on the amount of compensation that the employee has earned while working in MA. There is no minimum hours worked requirement.

The benefit amounts for MA PFML are as follows:

- Are paid at 80% of the employee’s average weekly wages for wages up to 50% of the state’s average weekly wage (SAWW).

- Any portion of the employee’s average weekly wages that exceeds 50% of the SAWW will be paid at 50% subject to a weekly benefit that is tied to the SAWW.

- The SAWW used for 2024 benefit calculations is $1,796.72.

- The 2024 maximum weekly benefit amount is $1,449.90; this amount will be adjusted to 64% of the SAWW annually.

- There is a seven-calendar day waiting period, that begins on the first day leave is taken, before benefits are paid.

- The waiting period must be satisfied for each new PFML leave except that there is no waiting period for family leave for bonding that is taken immediately after medical leave for childbirth.

- For intermittent or reduced schedule leave, the waiting period is 7 consecutive calendar days after the first instance of intermittent leave and not the aggregate accumulation of seven days of leave.

- The waiting period is counted as part of the annual allotment of PFML, but only for the days of leave actually taken during waiting period.

Covered employees who work in MA are allowed the following in a 12-month period:

- Up to 12 weeks of family leave for bonding with a newborn, adopted or foster child, care of a family member with a serious health condition, qualifying military exigency

- Up to 20 weeks of medical leave when an employee’s own serious health condition prevents the employee from being able to perform the job • Up to 26 weeks to care for an injured service member

- Up to 26 weeks of combined medical and family leave per benefit year

Benefit year is measured forward 52 weeks from the Sunday preceding the first day of the employee’s covered leave.

Family leave

- Bonding (caring for the employee’s own newborn, adopted or foster care placed child within the first 52 weeks of such birth, adoption, or placement)

- Care for a family member who was injured in the line of duty

- Military exigency as defined by the federal FLMA

- Care for a family member with a serious health condition

Medical leave

- Employee’s own serious health condition that prevents the employee from being able to work

The definition of serious health condition aligns with that used under the federal FMLA. Namely, a serious health condition is an illness, injury, impairment or physical or mental condition involving inpatient care or continuing treatment.

Family members include:

- Employee’s spouse or domestic partner

- child

- parent or parent of the employee or of the employee’s spouse or domestic partner

- grandchild

- grandparent

- sibling

- a person who stood in loco parentis to the employee when the employee was a minor child

- a child to whom the employee stands in loco parentis

An employee who has taken family or medical leave must be restored to the employee’s previous position or to an equivalent position, with the same status, pay, employment benefits, length-of-service credit and seniority as of the date of leave.

- MA PFML premiums may be shared between employer and employee. Under the MA PFML law, the family leave premium is allocated 100% to employees, while employers may charge employees up to 40% of the medical leave premium with the balance owed by the employer.

- Employers with less than 25 employees are not required to pay the employer portion of premiums for family or medical leave. However, employees of such employers will still be subject to payroll deductions for their portions.

Yes. If you currently have the MA PFML program with the state or through a different insurance carrier and you would like to transfer to Sun Life’s MA PFML private plan, we’ve outlined the steps you need to follow.

Employers may seek approval to meet their obligations of the MA PFML law through a private plan. If approved, the employer will not be required to submit premium payments to the DFML beginning on the first of the quarter following approval of the private plan. To meet the employer’s obligations, a private plan must:

- Provide leave for the same reasons

- Offer the same or greater maximum benefits

- Offer equal to or greater wage replacement amounts

- Allow leave to be taken on an intermittent or reduced schedule

- Impose no additional conditions or restrictions, and

- Specifically state that all presumptions shall be made in favor of the availability of leave and the payment of leave benefits.

If the private plan is in the form of:

- Self-insurance – the employer must furnish a surety bond running to the state (see next question)

- Fully insured – the policy must be approved by the insurance commissioner and be issued by an approved insurer.

Yes, if employers choose to offer MA PFML through a private plan administrator and it is a self-insured plan then a bond is required by the DFML.

Yes. While the MA PFML law creates certain paid benefits for leave because of an employee’s own health condition or for covered caregiving reasons, the MA PFML law is not intended to replace benefits provided by employers through Short Term Disability plans and programs. It is important to know that cancelling Short-Term Disability benefits could leave your employees unprotected if they become disabled for these reasons:

- Benefit amount for higher-income employees. The MA PFML maximum weekly benefit may be insufficient for high-income earners who require greater income replacement.

- Consequences of combined allotments of family and medical leave. If an employee takes the maximum amount of family leave, they will have a reduced amount of medical leave available for their own serious health condition.

- Impact of intermittent leave. MA PFML can be taken intermittently which can reduce the benefits available to the employee if they become seriously and continuously disabled thereafter.

- Short-term disability may offer additional features and benefits. Short-Term Disability policies may include employee-facing features that improve their experience: first-day hospitalization, survivor benefits, and, most important, return-to-work and vocational rehabilitation programs. Employees can still access these features even if they are approved for both MA PFML and Short-Term Disability.

You must renew your private plan as required by the DFML. Sun Life reminds Clients regularly of this obligation. There are penalties assessed by the state for employers who fail to renew their private plan. Additionally, while transferring among private plans can occur anytime, there are requirements and implications for moving from a private plan to the state plan.

-

More tools to prepare you for MA PFML

Questions?

Please call your Sun Life Client Relationship Executive.

If you have fewer than 100 employees, please call Client Services at 1-800-247-6875.

This content is not to be considered legal advice.

Fully insured Massashusetts Paid Family and Medical Leave coverage is underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) under Policy Form Series 20-PFML-GP-01-MA. Sun Life’s self-funded or administrative services-only MA PFML solution is administered by Sun Life Assurance Company of Canada. This service is not insurance.

We recommend Clients speak with legal counsel specializing in labor and employment law to ensure your organization has met all of the requirements under the MA PFML law, and other applicable leave laws including but not limited to the federal FMLA and the MA FMLA.

PFMLWC-2189 #1275100373 01/24 (exp. 01/26)