If you are not a broker or consultant, explore our content for plan members and families, employers, or dentists and dental offices.

Sun Life is eager to meet your Colorado Paid Family and Medical Leave (CO PFML) needs for private plan administration. Sun Life’s CO PFML plan integrates with its Short-Term Disability plans, featuring one claim submission, one claim number, one case manager, and integrated reporting for employers.

Sun Life has created this page for employers and brokers to help comply with responsibilities under the CO PFML law. Please visit this site often for updates.

Additionally, the FAMLI Division is the agency responsible for administering the CO PFML law. Information from the FAMLI Division about private plans can be found on the Colorado Family and Medical Leave Insurance Program (FAMLI) website.

Quick Facts

Key Dates

- January 1, 2023 – Employers covered by the FAMLI Act need to start collecting premiums

- October 31, 2023 – Last day Employers must apply to the FAMLI Division for a private plan exemption approval to ensure the FAMLI Division can review and approve an employer’s request for a private plan exemption prior to January 1, 2024

- January 1, 2024 – Benefits start

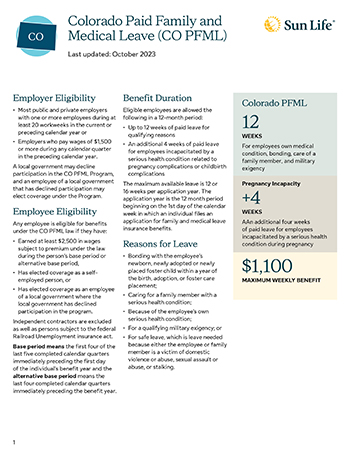

Benefit Duration

- 12 weeks of paid leave in a 12-month period

- Additional 4 weeks for employees incapacitated by a serious health condition during pregnancy

Reasons for Leave

- Bonding with the employee’s newborn, newly adopted or newly placed foster child within a year of the birth, adoption, or foster care placement

- Caring for a family member with a serious health condition

- For one’s own serious health condition

- For a qualifying military exigency

- For safe leave, which is leave needed because either the employee or family member is a victim of domestic violence or abuse, sexual assault or abuse, or stalking of either the employee or a family member

Maximum Weekly Benefit

- $1,100

Frequently Asked Questions

Sun Life is committed to assisting you in complying with the requirements of the new CO PFML law and with providing valuable employee benefits to your employees. We also offer leave and accommodations administration services. Please reach out to us and we will evaluate your benefit plans and compliance needs from a holistic perspective and provide guidance and services to meet you and your employees’ needs.

Content is subject to change as Sun Life receives guidance from states and municipalities. This content is not to be considered legal advice. We recommend Clients speak with legal counsel specializing in labor and employment law to ensure your organization has met all of the requirements under the Colorado Paid Family & Medical Leave (PFML) Act, and other applicable leave laws including but not limited to the federal FMLA and the Colorado Family Leave Act. Sun Life’s fully insured CO PFML coverage is issued by Sun Life Assurance Company of Canada (Wellesley Hills, MA) under 23-FAMLI-GP-01-CO. Sun Life’s self-funded or administrative-services-only CO PFML solution is administered by Sun Life Assurance Company of Canada (Wellesley Hills, MA). This service is not insurance.

PFMLWC-949 SLPC 31764 09/23 (exp. 08/24)